Understanding Asset Classes

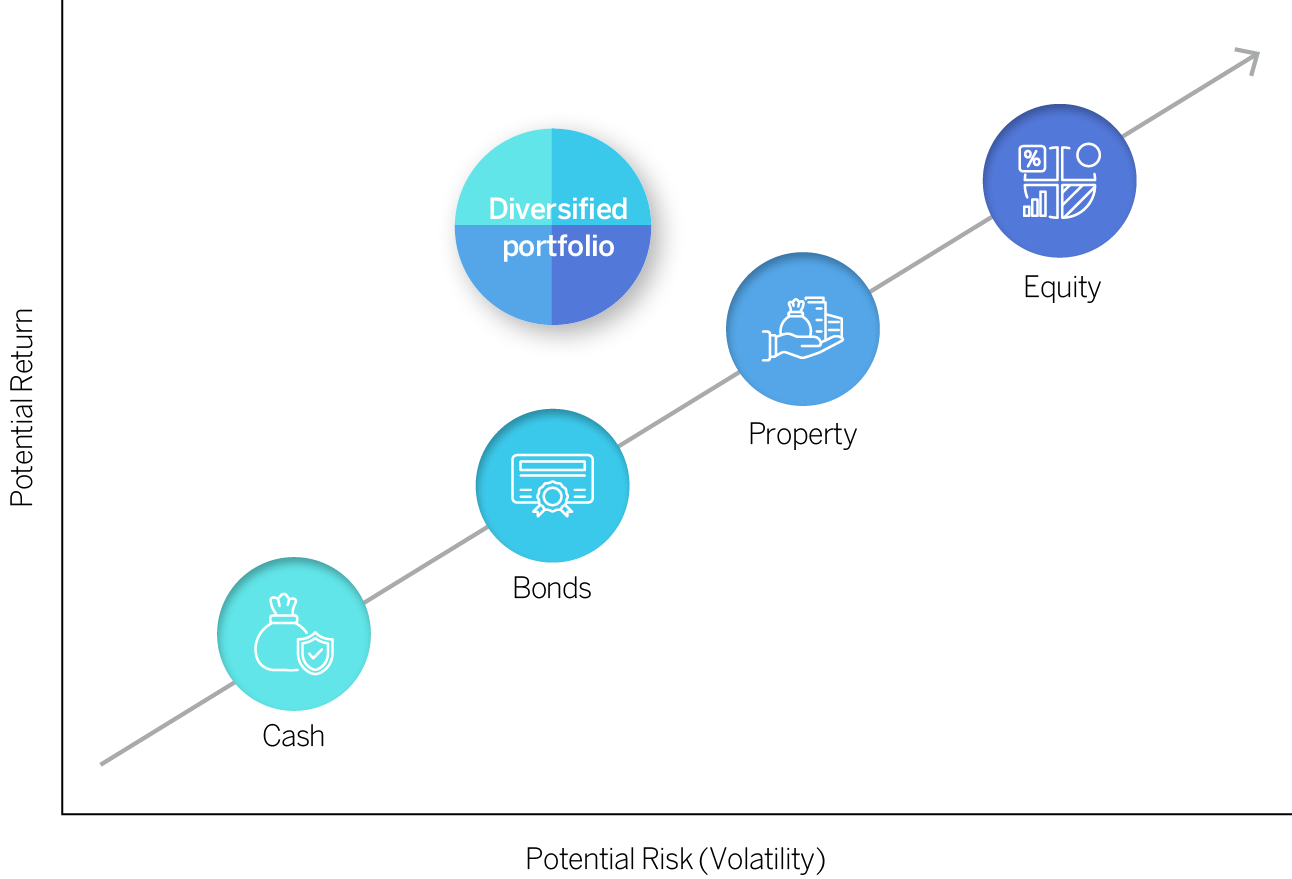

In today’s complex and ever-changing investment landscape, understanding the concept of asset allocation has become more crucial than ever before. Asset allocation is one of the most important decisions that an investor will make and finding the right asset allocation for each financial goal has no simple formula.

Asset allocation is not a one-size-fits-all approach but rather a personalised strategy that takes into account an individual’s unique circumstances, risk tolerance, and investment objectives.

By diversifying investments across various asset classes, such as shares, bonds, cash, property, and commodities, investors can balance risk and return, enhance portfolio stability, and maximise potential gains. With this in mind, let’s get started.

Cash

This is the most liquid asset class. A cash investment tends to be seen as lower risk and lower return. It can be a useful tool for risk-averse investors, or a temporary home for money in between long-term investments.

Bonds

When you purchase a bond, you are a bond holder by lending money to the issuer. Bonds provide a regular income stream by paying a coupon on regular intervals, over a specific period, and promises to return the value of the bond on a set date in the future (the maturity date). Bonds have historically offered stable returns and are perceived to carry lower risk than equities. That said, bonds can experience capital gains or losses prior to the maturity date. In addition, there is the risk that the bond issuer will be unable to fulfil their obligation to pay - this is known as a default.

Property

Real estate or physical property assets are considered an asset class that offers protection against inflation. This asset class includes Real Estate Investment Trusts (REITs).

Equity

This is also known as “ordinary shares” or “shares”. Equities are issued by a public limited company and traded on stock markets. There are two ways equities can potentially increase your investment: receiving capital growth through increases in the share price, and/or you can receive dividends. There is no guarantee that dividends will be paid and there is also a risk that the share price can drop below the level at which you invested.

Cash

This is the most liquid asset class. A cash investment tends to be seen as lower risk and lower return. It can be a useful tool for risk-averse investors, or a temporary home for money in between long-term investments.

Bonds

When you purchase a bond, you are a bond holder by lending money to the issuer. Bonds provide a regular income stream by paying a coupon on regular intervals, over a specific period, and promises to return the value of the bond on a set date in the future (the maturity date). Bonds have historically offered stable returns and are perceived to carry lower risk than equities. That said, bonds can experience capital gains or losses prior to the maturity date. In addition, there is the risk that the bond issuer will be unable to fulfil their obligation to pay - this is known as a default.

Property

Real estate or physical property assets are considered an asset class that offers protection against inflation. This asset class includes Real Estate Investment Trusts (REITs).

Equity

This is also known as “ordinary shares” or “shares”. Equities are issued by a public limited company and traded on stock markets. There are two ways equities can potentially increase your investment: receiving capital growth through increases in the share price, and/or you can receive dividends. There is no guarantee that dividends will be paid and there is also a risk that the share price can drop below the level at which you invested.

Income

Growth

Can a fund invest in just one asset class?

Yes.

A fund that invests in only one asset class is typically referred to as a specialist or building block fund, whereas a fund that invests in multiple asset classes is known as a multi-asset fund. By investing across multiple asset classes, a portfolio can benefit from increased diversification, which in turn can help to lower risk (as measured by volatility) compared to investing in a single asset class.Why investing in different asset classes can be better for you?

Diversification across multiple asset classes is important for reducing risk as certain asset classes are more prone to volatility than others. By avoiding the concentration of investments in a single asset class, you increase your chances of success. Diversifying across various asset classes with different return profiles that fluctuate under varying market conditions can help protect against significant losses. When market conditions favour one asset class, they may lead to average or poor returns in another asset class. By spreading your investments across different asset classes, you can expect more stable returns (less volatility) and reduce the risk of losing money.

Regulation 28 of the Pension Funds Act limits the exposure to equity and property (growth assets) as well as credit exposure on bonds to name a few. This is done to ensure investors’ retirement savings have a suitably diversified investment portfolio.